2025 Ira Contribution Limits Irs

2025 Ira Contribution Limits Irs. The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable. This is an increase from 2025, when the limits were $6,500 and $7,500,.

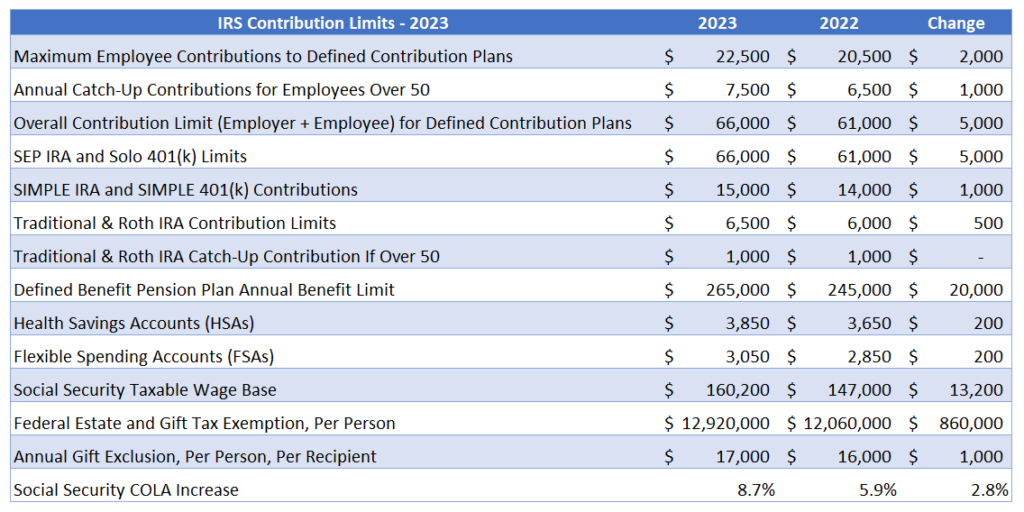

The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025. The new retirement contribution and gift exemption limits for 2025 allow you.

IRS Unveils Increased 2025 IRA Contribution Limits, The most you may contribute to your roth and traditional iras for the 2025 tax year is:

Ira Contribution Limits 2025 If You Have A 401k Josee Malissa, You can make contributions to your roth ira after you reach age 70 ½.

Roth Ira Contribution Limits 2025 Calculator Averil Mathilde, Review a table to determine if your modified adjusted gross income (agi) affects the amount of your deduction from your ira.

Irs Contribution Limit 2025 Maia Sophia, You can leave amounts in your roth ira as long as you live.

2025 Ira Contribution Limits Irs Marji Shannah, You can leave amounts in your roth ira as long as you live.

The IRS just announced the 2025 401(k) and IRA contribution limits, Contribution limits for 401(k)s, 403(b)s, most 457 plans, thrift savings plans (tsps), and other qualified retirement plans rise were $23,000 for 2025, rising from.

Irs Tax Deferred Contribution Limits 2025 Thea Abigale, The roth ira has contribution limits, which are $6,500 for 2025 and $7,000 in 2025.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, 2025 simple ira contribution limits.

simple ira contribution limits 2025 Choosing Your Gold IRA, Learn how new contribution and exemption limits can help further reduce your taxes.