Ira Income Limits 2025 For Deduction Under

Ira Income Limits 2025 For Deduction Under. The deduction may be limited if you or your spouse is covered by a retirement plan at work and your. The table below shows the aggregate contribution limits for these two accounts by tax.

Find out if you can contribute and if you make too much money for a tax deduction. If you are covered by a retirement plan at work, use this table to determine if your modified agi affects the amount of your deduction.

Ira Limits 2025 For Conversion Alice Babette, Find out if you can contribute and if you make too much money for a tax deduction. Your personal roth ira contribution limit, or eligibility to.

What Is The Limit For Ira Contributions In 2025 Ilysa Leanora, If you are covered by a retirement plan at work, use this table to determine if your modified agi affects the amount of your deduction. The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable.

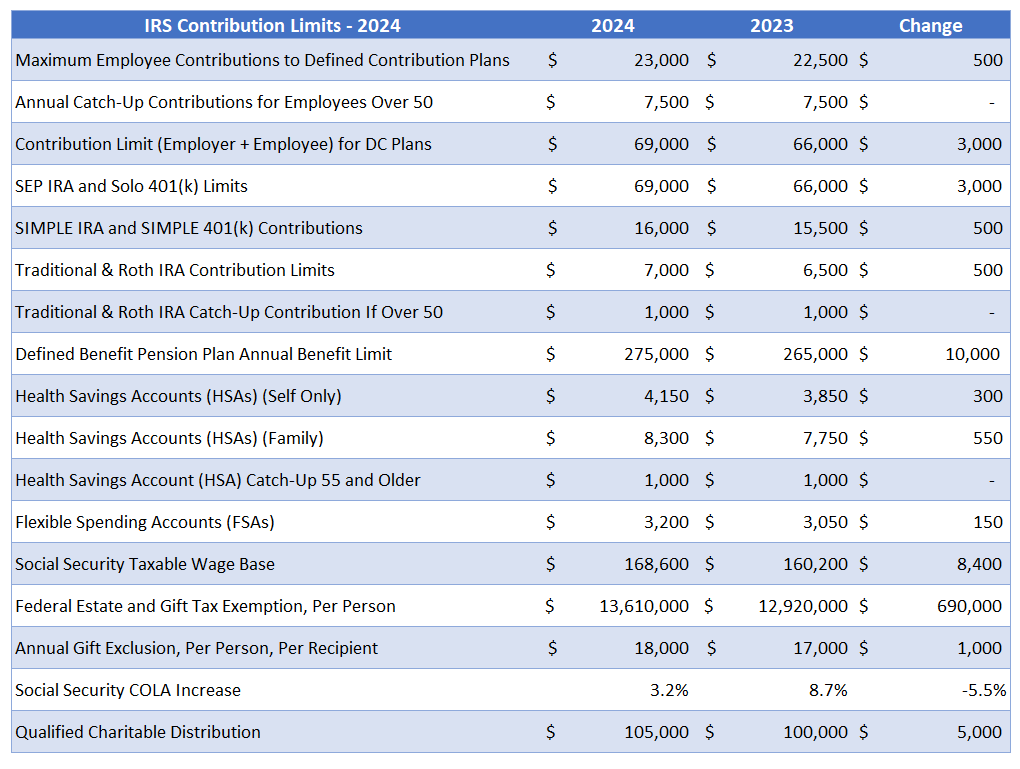

IRA Contribution Limits 2025 Finance Strategists, For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025. For 2025, you can contribute as much as $7,000 to an ira or $8,000 if you're age 50 and older.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, The roth ira contribution limits are $7,000, or $8,000 if. $6,500 if you're younger than age 50.

Ira Limits 2025 For Deductions 2025 Cheryl Thomasina, The table below shows the aggregate contribution limits for these two accounts by tax. The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, Find out if you can contribute and if you make too much money for a tax deduction. Learn how ira income limits vary based on which type of ira you have.

Roth Ira Limits 2025 Irs Sukey Stacey, See iras for more information. The roth ira income limit to make a full contribution in 2025 is less than $146,000 for single filers, and less than $230,000 for those filing jointly.

Roth Ira Limits 2025 Irs, The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable. The irs recently announced the 2025 ira contribution limits, which are $500 more than the limits for 2025.

Limits For Roth Ira Contributions 2025 Gnni Shauna, For 2025, the annual contribution limit for simple iras is $16,000, up from $15,500 in 2025. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government's thrift savings plan can contribute up to $23,000 in 2025, a $500 increase.

IRS Unveils Increased 2025 IRA Contribution Limits, The 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly. $7,500 if you're aged 50 or older.

If you are covered by a retirement plan at work, use this table to determine if your modified agi affects the amount of your deduction.